Skid Steer Market Overview March–August 2025 eBay : eBay’s Seller Hub data illustrates that the U.S. skid steer loader market has been stable from March through August 2025, indicating a strong buyer turnout for both new and used machines. The need was spread out, with compact mini skid steers being used by landscapers and small contractors, while full-size models were utilized in construction and land management.

- The average prices of the sold goods on eBay varied considerably. While the prices of accessory units or project models were at the level of $572, the price of the hardly-used flagship models by the leading brands such as Caterpillar and Bobcat almost touched $40,000.

- One of the strongest factors that pushed the popularity of many of the successful listings and ensured a high turnover rate was the offer of free shipping and no hidden fees.

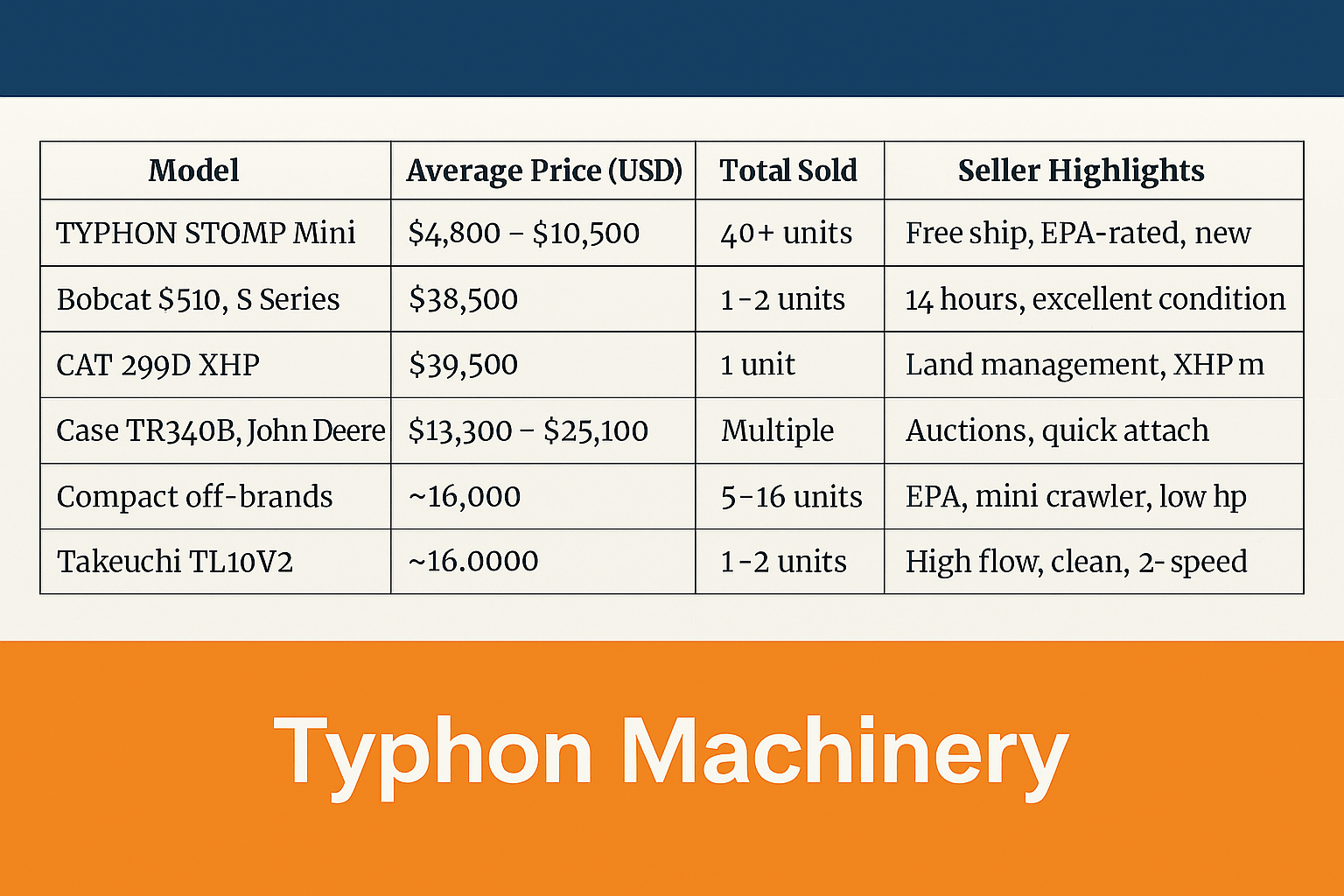

Skid Steer Market Overview: Top Performing Skid Steer Brands & Models

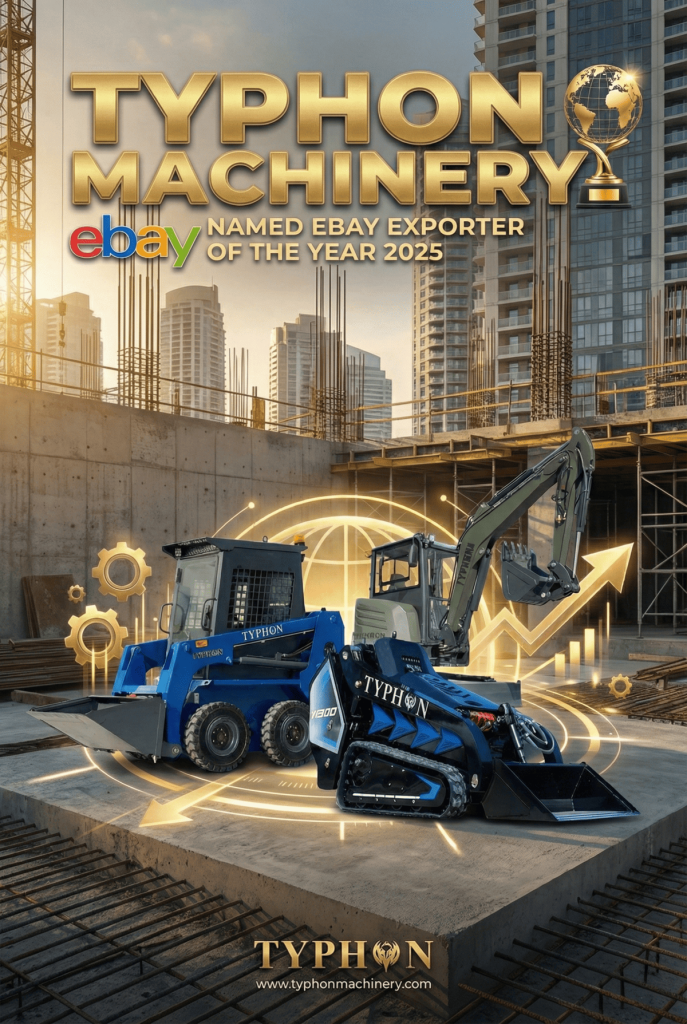

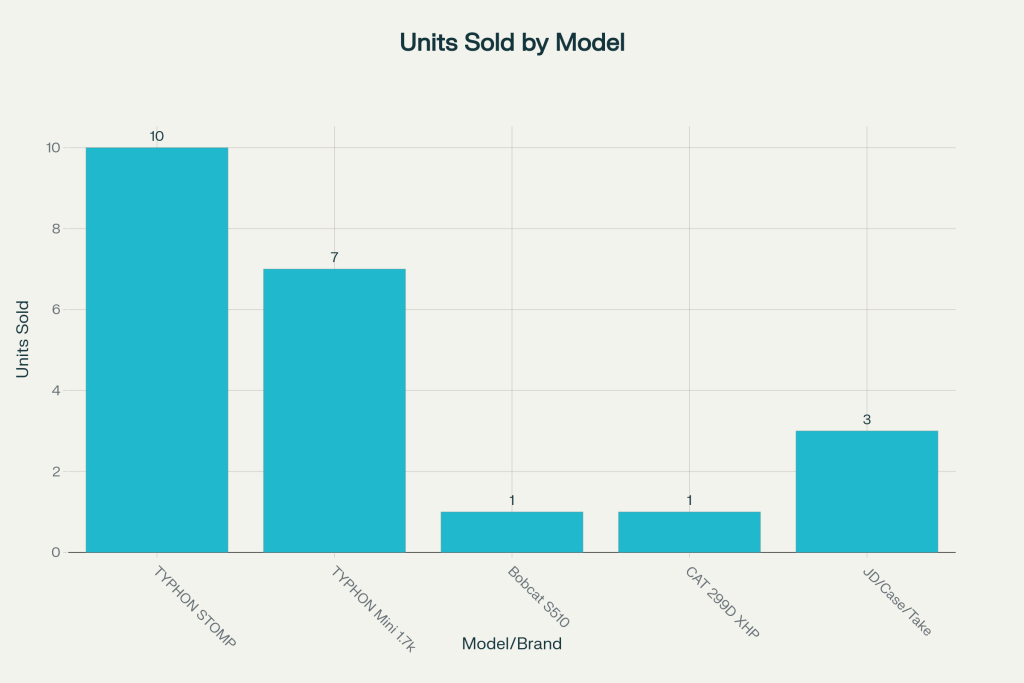

The period showcased multiple brands that performed exceptionally well, along with particular models. While the likes of classic house brands such as General Motors and Ford dominated the scene, a fresh-faced company like TYPHON also managed to rise above the competition and conquer the marketplace with their innovative idea.

- TYPHON STOMP Mini Skid Steer Loaders (22–35 HP Gasoline/Honda EPA Engines): Consistently led compact and affordable new model sales volumes most of the time with units typically selling at a price between $4,800 and $10,500 and with very strong monthly unit sales.

- Bobcat S510 & S Series: Kept up the trend of high average selling prices (up to $38,500 for almost-new S510s), thus, being the main factor in brand loyalty among contractors who prefer conventional brands.

- CAT (Caterpillar) 299D XHP: Obtained the maximum individual sale at $39,500, a demonstration that the top-tier, well-kept models are still the first choice for heavy-duty buyers.

- Case, John Deere, Takeuchi: The sale of the TR340B, 325G, 333G, and Takeuchi TL10V2 models have been stable over time with average sale prices varying between $13,000 and $25,000 depending on year, condition, and included attachments.

Note: Aggregated totals may include multiple price points per variant and include tracked/wheeled configurations.

Price Analysis and Value Trends

During the examination period, the prices of skid steer revealed a very complicated nature that included factors like brand premium, age/condition, and engine power. Buyer choices were influenced by several patterns.

- Premium Brand Value: A few top brands (CAT, Bobcat, John Deere, Case, Takeuchi) were able to get higher prices for their products, especially if they were equipped with high-flow hydraulics, quick-attach features, and recent years of production (2021–2025).

- Compact & Mini Segment Growth: The sales increased dramatically for smaller, EPA-rated mini skid steers (13–23 HP) from brands like TYPHON, HUAYEE, and KATOOL that were usually priced $4,000–$7,000. Free shipping and U.S. warehouse stock made these value buys for smaller contractors and landscaping businesses.

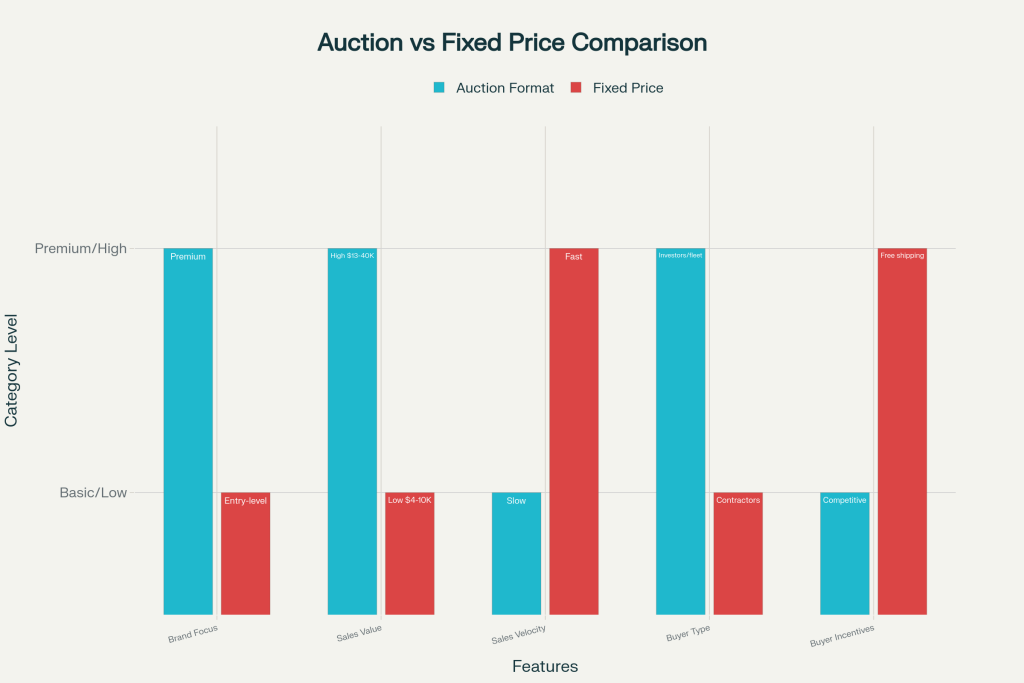

- Auction vs. Fixed Price: Although the most expensive models (CAT, Bobcat) were sold at a high price at auction, mini and less-known brands had the highest performance when fixed price listings were used because they could immediately be bought due to the existence of an instant purchase button.

Buyer Demand and Seasonal Trends

- March to May: Sales energy was developed in a gradual way and specially one of the kinds of sales – fixed price and free shipping – showed a marked growth that was in line with the start of construction season in North America.

- June–August Peak: The period when most outdoor activities were conducted gave rise to transaction volumes that reached their peak especially for mini skid steer loaders which were aimed at landscapers and rental fleets. Sellers’ focus on free shipping, EPA certification, and U.S. stock availability continued to convert more buyers into purchasers, with buyer impatience for delivery during the season being also noticeable.

- End of August: Listings moved a bit towards model specials and bundle deals as sellers tried to unload their summer stock before the fall season, which is slower, arrives.

Pricing and Sales by Month (High-Level Overview)

- March: Higher volumes in mid-tier segments ($4,000–$7,000).

- April–June: Consistent sales of both premium models ($16,000–$39,500) and minis.

- July–August: Strong volume in mini and mid-tier, slight drop in premium brand turnover, but auctions still commanded top-dollar for select listings

Competitive Product Positioning: Typhon vs. Established Brands

TYPHON has been able to get the attention of the volume part of the market for new equipment in the entry-level segment in a remarkable way. Typhon’s “STOMP” line, by providing EPA-certified, dependable mini loaders at very competitive price points and with a strong free shipping guarantee, demonstrates that aggressive digital retail, combined with U.S.-based fulfillment, can garner even more share than that of well-known giants.

Strengths for Typhon:

- Secure the interest of buyers who are after immediate delivery and value

- Landscaping/startup contractor segments are accessible by price wide enough

- EPA certification, quick-attach, and Honda engines were some of the features that enabled customers’ trust climate

Limitations vs. Giants:

- It was missing some elements such as advanced brand trust, depreciation strength, and long-term fleet value of Bobcat, CAT, or John Deere for institutional buyers.

Conclusion: Key Takeaways for Skid Steer Sellers and Buyers

- Skid steer quick-shipping, EPA-rated mini models under $10,000 have been trending in the spring/summer 2025 eBay U.S. market; nevertheless, flagship used unit premium auction sales remain strong.

- Besides that, emerging brands, trust and transparency inspired by the sales approach, together with EPA standards and fast fulfillment, are the elements that bring them rapid market share growth even against more established competitors.

Detailed Insights: Skid Steer Loader Sales (March–August 2025)

General Market Overview

- Skid steer loader sales covered a wide price range, which included low-end accessory units of approximately $572 and high-tier machines of nearly $40,000.

- The market had a dual impetus of new listings for small, value-oriented brands (especially TYPHON) and the already existing brands with a big number of recent model machines such as CAT, Bobcat, Case, John Deere, Takeuchi, and others.

- Regular free shipping choices and clear listing were significant motivations for buyers.

Top Brands and Models Sold

- TYPHON Mini Skid Steers (13.5–35 HP): Sold over 40 units across different models, price points ranging from about $4,800 to $10,500. Features highlighted: Honda EPA gas engines, quick-attach features, EPA compliance, and robust U.S. delivery support.

- Bobcat S510 Wheel Skid Steer (2024 models): Sold at $38,500, highlighting its status as a sought-after low-hour, high-performance compact loader.

- CAT 299D XHP (2015 model): Achieved the highest price for an auction at $39,500, emphasizing high horsepower and land management applications.

- Case TR340B, John Deere 325G/333G, Takeuchi TL10V2: Routinely traded at $13,000–$25,100 depending on age, features, and included attachments or cab options.

Sales Volume and Pricing Patterns

- Mid-tier and premium brand models made up most of the high-value auction sales.

- The greatest volume was observed in value-packed mini skid steers (EPA-certified, 13.5–23 HP) priced between $4,000 and $7,000. These include TYPHON, HUAYEE, and KATOOL models.

- Many lower and mid-priced units (new and mini) offered flat rate or free shipping—an attractive draw for individual contractors and small fleet buyers.

Month-by-Month Trends

- March: Sales heavily favored mid-tier new models and minis (<$7,000), with buyers ramping up as the construction season began.

- April–June: Consistent sales across price ranges; loads of volume for replacement minis and several auctions for premium used units.

- July–August: Mainstream demand for mid-tier compact models ($4,000–$7,500), mild drop in rotating stock for flagship used brands, but auctions still driving substantial value for Bobcat and CAT units.

Key Features in Successful Listings

- Free shipping was standard for nearly all high-volume mini loader listings, including TYPHON, HUAYEE, and KATOOL.

- EPA engine certifications—both for mini and full-size models—were clearly stated in product titles and consistently mentioned in detailed descriptions, securing trust from buyers in states with strict environmental regulations.

- New models frequently included the “in-stock/US warehouse” assurance for faster delivery.

- Popular options and configurations:

- Hydraulic quick attach

- Honda or Briggs & Stratton gasoline engines (13.5–23 HP for minis)

- Track and wheel options

- Joystick controls, cab heat/AC for larger examples

Specific Models & Summary (Representative Sales)

Price Ranges (Mini vs. Standard-Size Skid Steers)

-

Mini Skid Steers (13.5–23 HP, EPA, new): Predominant range $4,000–$7,000 per unit with higher sales by volume.

-

Standard-size/Flagship Used Brands (premium, low hours): $14,000–$40,000, fewer total units but consistently strong for Bobcat, CAT, John Deere, Case, and Takeuchi.

Shipping and Condition Factors

- Free shipping and fixed price listing models dominated the successful new and mini sales category.

- Auction formats delivered highest value for top-tier used machines, with bidding reflecting strong market confidence in recognized fleet units.

- Descriptions emphasized maintenance status (“immaculately kept,” “clean,” “owner use only”), as well as attachment inclusions (e.g., buckets, quick couplers).

Seller Tactics and Buyer Considerations

- Detailed, multi-photo listings with clear hours/usage, high-quality photos (cab, serial, hour meter, engine), and transparent titles featuring model, year, and main features (“22HP USA STOCK,” “EPA Gas,” “Free Ship”) outperformed less detailed listings.

- EPA engine certification, a U.S. warehouse presence, and guaranteed inventory were the key factors that increased buyer confidence—especially those commercial customers that required immediate deployment.

What were the top-selling skid steer loader brands and models on eBay from March to August 2025, and what factors contributed to their sales performance?

According to the attached sales research, the top-selling skid steer loader brands and models on eBay from March to August 2025 were:

- TYPHON STOMP Mini Skid Steers (22.1HP Honda EPA Gasoline Engine)

- During this timeframe, these mini skid steers became the highest volume sellers on eBay, with a total of more than 40 units sold.

- The usual price was between $4,800 and $10,500.

- The main reasons behind the sales were the implemented EPA certification, free shipping, quick-attach hydraulic systems, U.S.-based warehouse stock that allowed a speedy delivery, and the product’s beauty to landscaping and small contractor buyers.

- Bobcat S510 and S Series

- Machines like the Bobcat S510 (2024 model with very few used hours) sold at around $38,500, which was a good example of the luxury class.

- The need for the brand was kept very high by the assistance of the stable brand reputation, very good performances, and few used hours.

- The auction sales of these models were the main source of the high prices received in return.

- One of the top brand models was the Bobcat S510 2024, with only a few hours of use and that was sold for about $38,500.

- The high demand of the brand was mostly due to its good reputation, excellent performance, and low hours of use.

- The main part of the highest prices was from the auction sales of these models.

- Caterpillar (CAT) 299D XHP The most significant individual sale was $39,500 for a 2015 CAT 299D XHP, standard land management, and high horsepower application model. The main reason it was highly valued was due to its long life, brand, and robustness.

- The single highest sale was $39,500 for a 2015 CAT 299D XHP, which is a standard land management and high horsepower application model.

- The main reasons for the product to have a high value were durability, brand power, and solid features.

- Other Notable Brands and Models The new, less popular used equipment brands and models featured in this news and only a few units from these companies got to be auctioned in San Jeronimo, created a stir among enthusiasts include: John Deere 325G/333G, Case TR340B, Takeuchi TL10V2. These brands had regular sales mainly through used equipment auctions, and the sale prices were between $13,000 and over $25,000 depending on the year, condition, and attachments offered.

- John Deere 325G/333G

- Case TR340B

- Takeuchi TL10V2

- These brands were regularly sold mainly through used equipment auctions, and the sale prices ranged from $13,000 to over $25,000 depending on the year, condition, and attachments offered.

Among the factors that greatly highlighted the sales performance were:

- Free shipping and fixed prices for mini loaders made the purchases more simple and attractive to the buyers.

- EPA-compliant engines were the key feature in the ads to attract buyers from states with strict environmental regulations.

- Expedited shipping from U.S. warehouses shortened delivery time and eliminated the uncertainty.

- Confidence of buyers was raised by the detailed listings with several photos and clear descriptions of maintenance, usage, and included attachments.

- Low price entry points in the mini loader segment with strong features were the reason of the high sales volume.

- The strong, recognizable brand names like Bobcat, CAT, and John Deere were the main reason for maintaining the premium pricing in the market.

In general, TYPHON was the leader of the mini skid steer segment through value, availability, and compliance, whereas established brands retained the high-end used equipment market on eBay.